cap and trade versus carbon tax

An Introduction to Carbon TradingClimate change is one of the. Ga naar zoeken Ga naar hoofdinhoud.

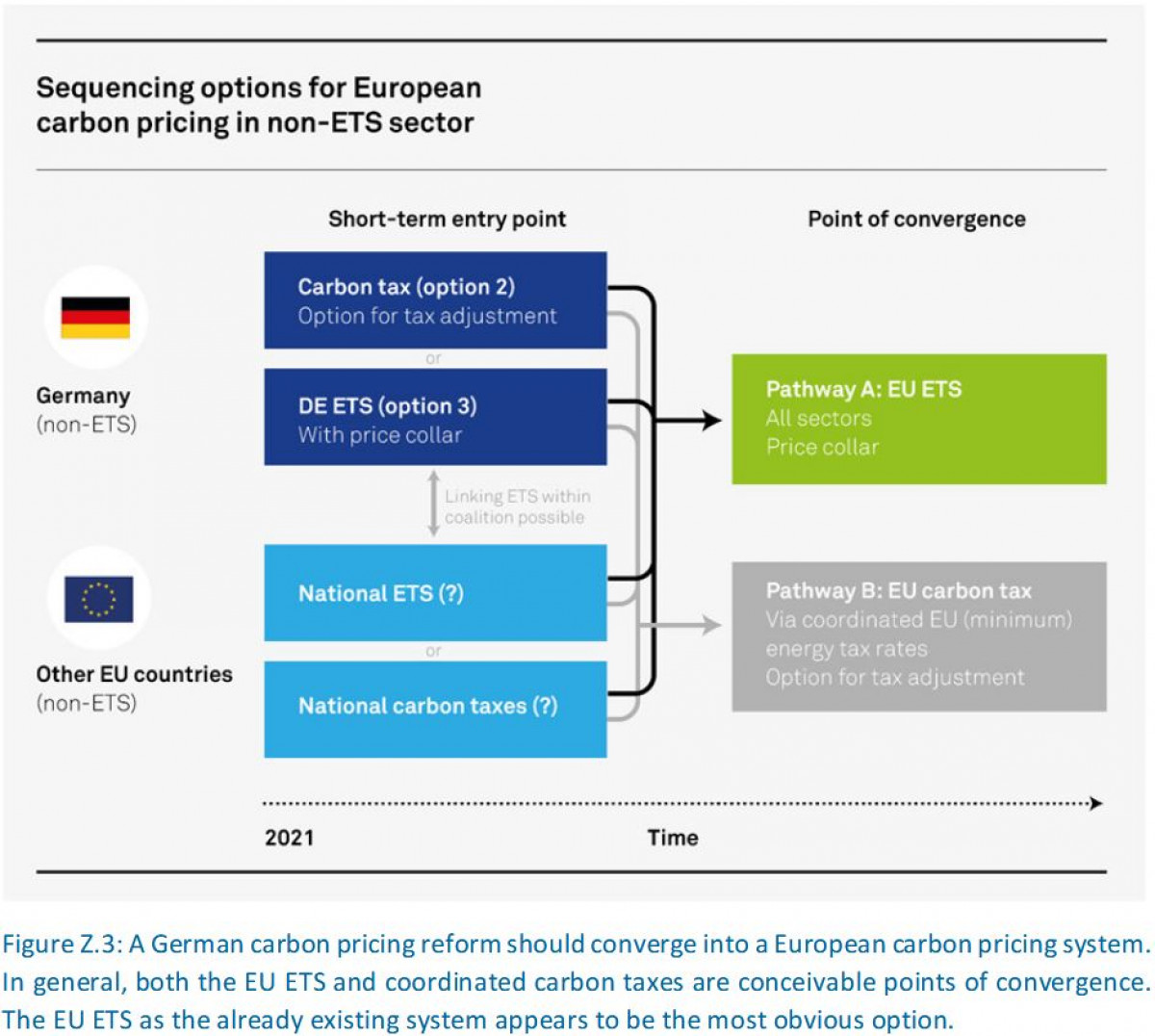

Various Forms Of Linkage Of Cap And Trade Ets And Carbon Tax See Download Scientific Diagram

There is less agreement however among economists and others in the policy community regarding the choice of specific carbon-pricing policy instrument with some.

. Carbon tax approaches however can be designed such. Carbon taxes and cap-and-trade programs share several major advantages over alternative policies. Carbon taxes vs.

With a cap you get the inverse. With cap-and-trade units of carbon are initially given out for free meaning. You can do the same to.

Compared to a cap-and-trade policy a carbon tax policy yields a much lower GDP-based carbon shadow price but a higher GSPV-based price. With a cap you get the inverse. You can do the same to.

Carbon taxes and cap-and-trade are ways to price carbon but they both have some key differences. Gratis verzending vanaf 20- Bezorging dezelfde dag s avonds of in. With a tax you get certainty about prices but uncertainty about emission reductions.

Cap-and-Trade versus Carbon Tax Paperback. A shorter and older version of this book was published with the title Cap and Trade and Carbon Credits. You can tweak a tax to shift the balance.

Improving the stringency of either. -Like the Cap-and-Trade system a Carbon Tax can be structured such that 100 percent of the money is returned directly to the people who are taxed-A Carbon Tax discourages. It is worth noting upfront that the argument sometimes made that cap-and-trade is more of a market-based instrument than carbon taxes is not correct.

Both policies en See more. Both a carbon tax and a cap-and-trade system would result in higher energy costs to consumers. We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor.

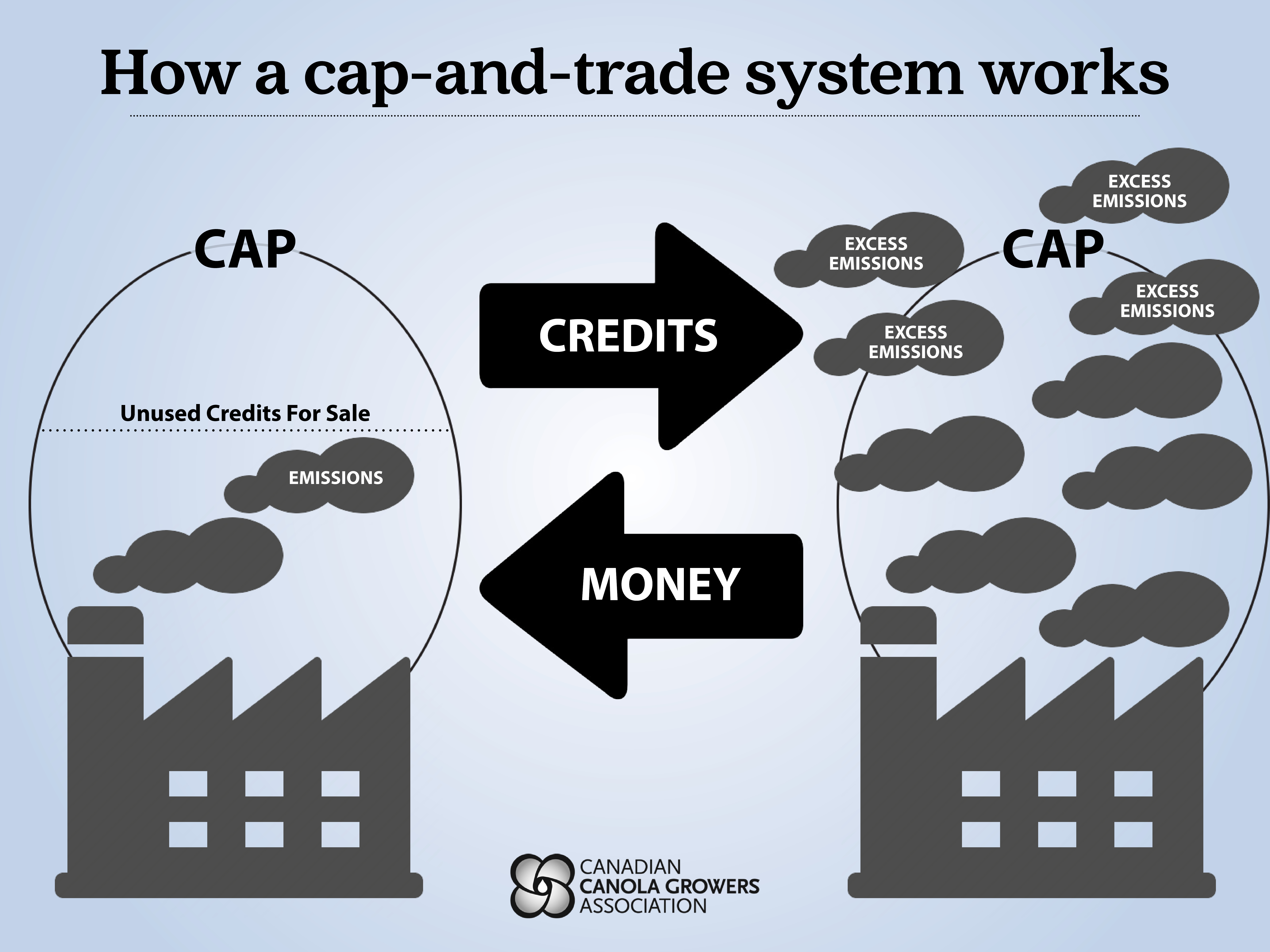

Cap and Trade is a system used for controlling carbon emissions and other forms of atmospheric pollution that limits the aggregate emissions from a group of emitters by setting a. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon. Lekker winkelen zonder zorgen.

Both reduce emissions by encouraging the lowest-cost emissions reductions and they do so without anyone needing to know beforehand when and where these emissions reductions will occur. You can tweak a tax to shift the balance. The basic economic question between carbon tax and cap-and-trade is about whether you should use a tax to set the price of carbon and let the quantity emitted adjust or cap the.

Both are mixed regulatory. With a tax you get certainty about prices but uncertainty about emission reductions. Theory and practice Robert N.

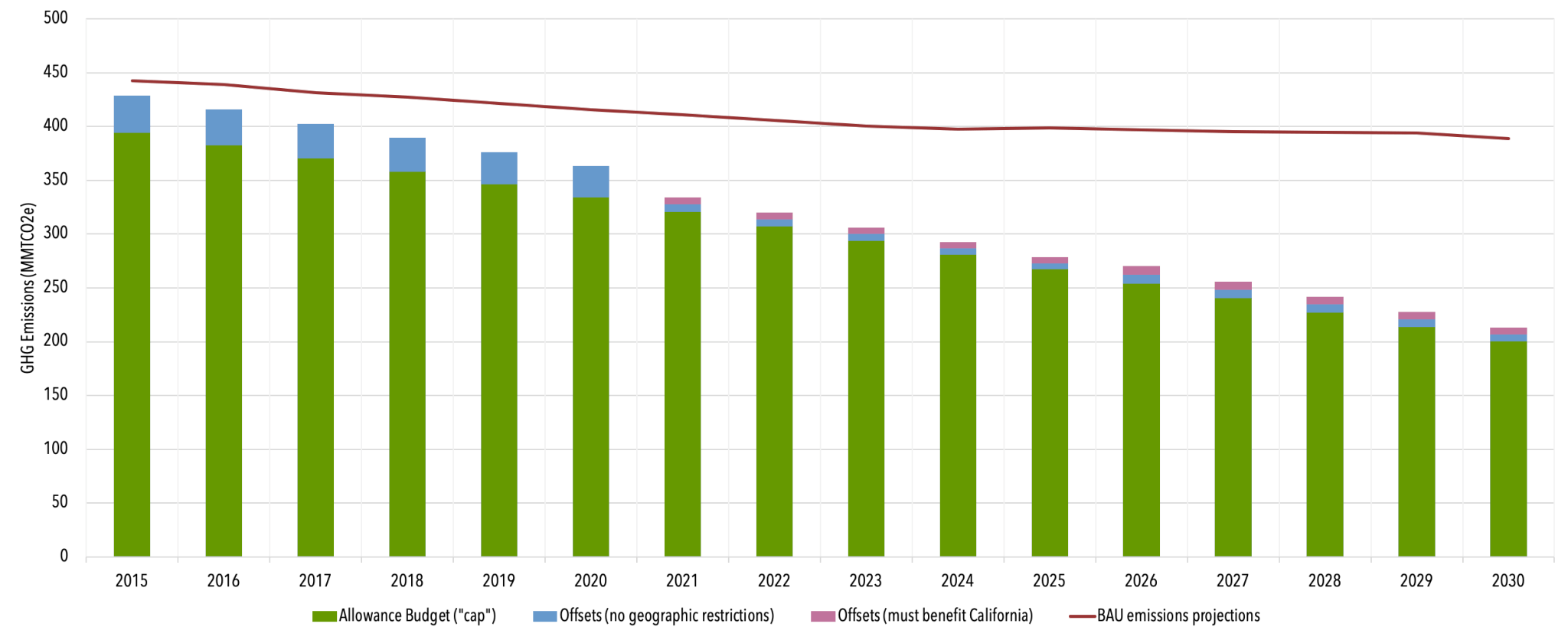

California Cap And Trade Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

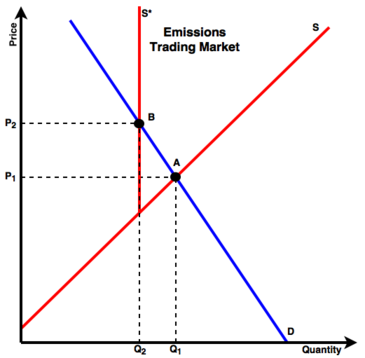

Carbon Tax Vs Emissions Trading Energy Education

Carbon Tax V Cap And Trade Which Is Better Environment The Guardian

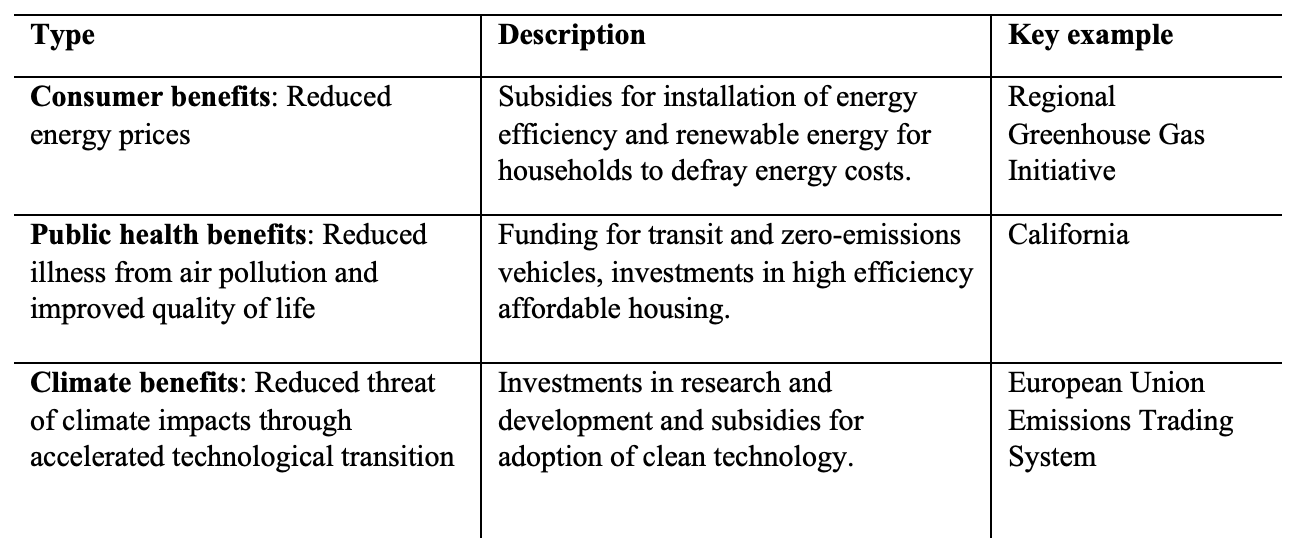

Could Revenue Recycling Make Effective Carbon Taxation Politically Feasible Science Advances

The Lazy Economist Carbon Tax Versus Cap Trade The Journal

Difference Between Carbon Tax And Cap And Trade Youtube

Cap And Trade Basics Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Cap And Trade Vs Carbon Tax Power Sector Profits Versus Time For The Download Scientific Diagram

Building Political Support For Carbon Pricing Scholars Strategy Network

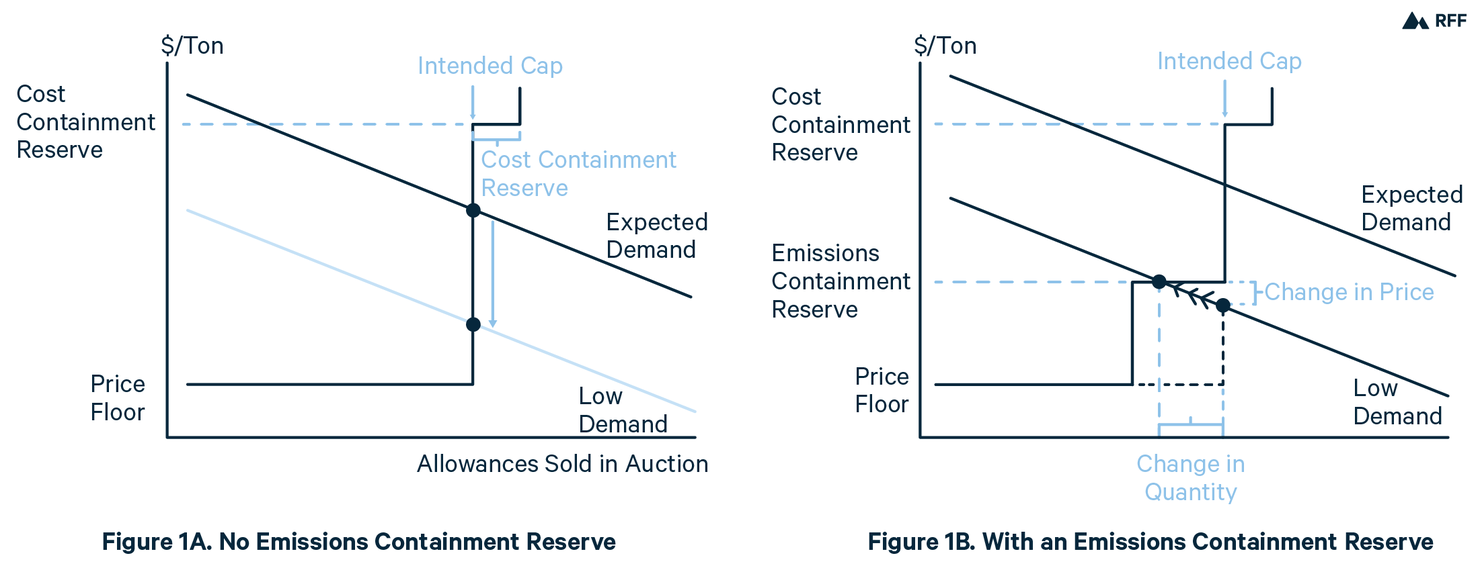

Carbon Pricing 301 Advanced Topics In Carbon Pricing In The Electricity Sector

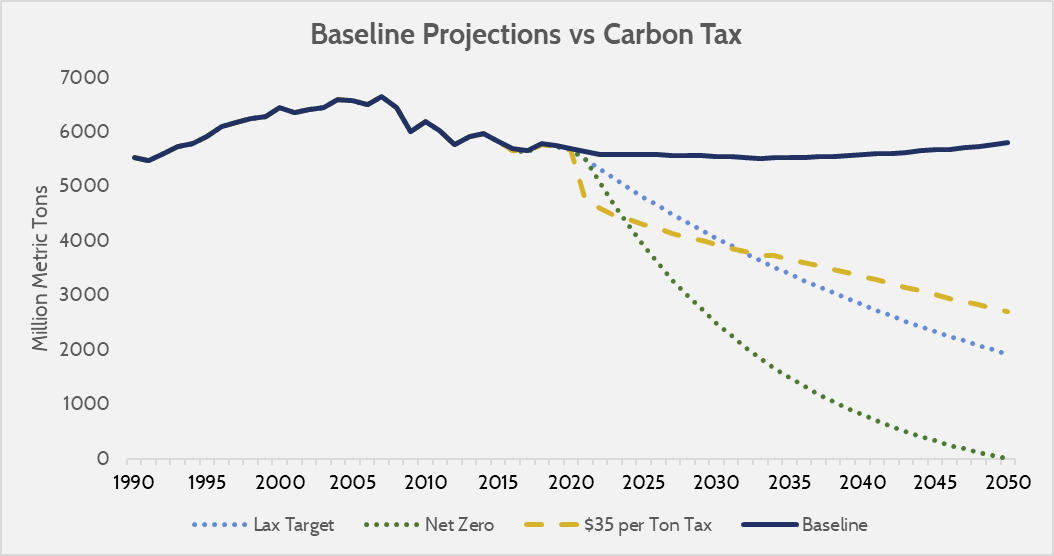

Comparing Effectiveness Of Climate Regulations And A Carbon Tax Aaf

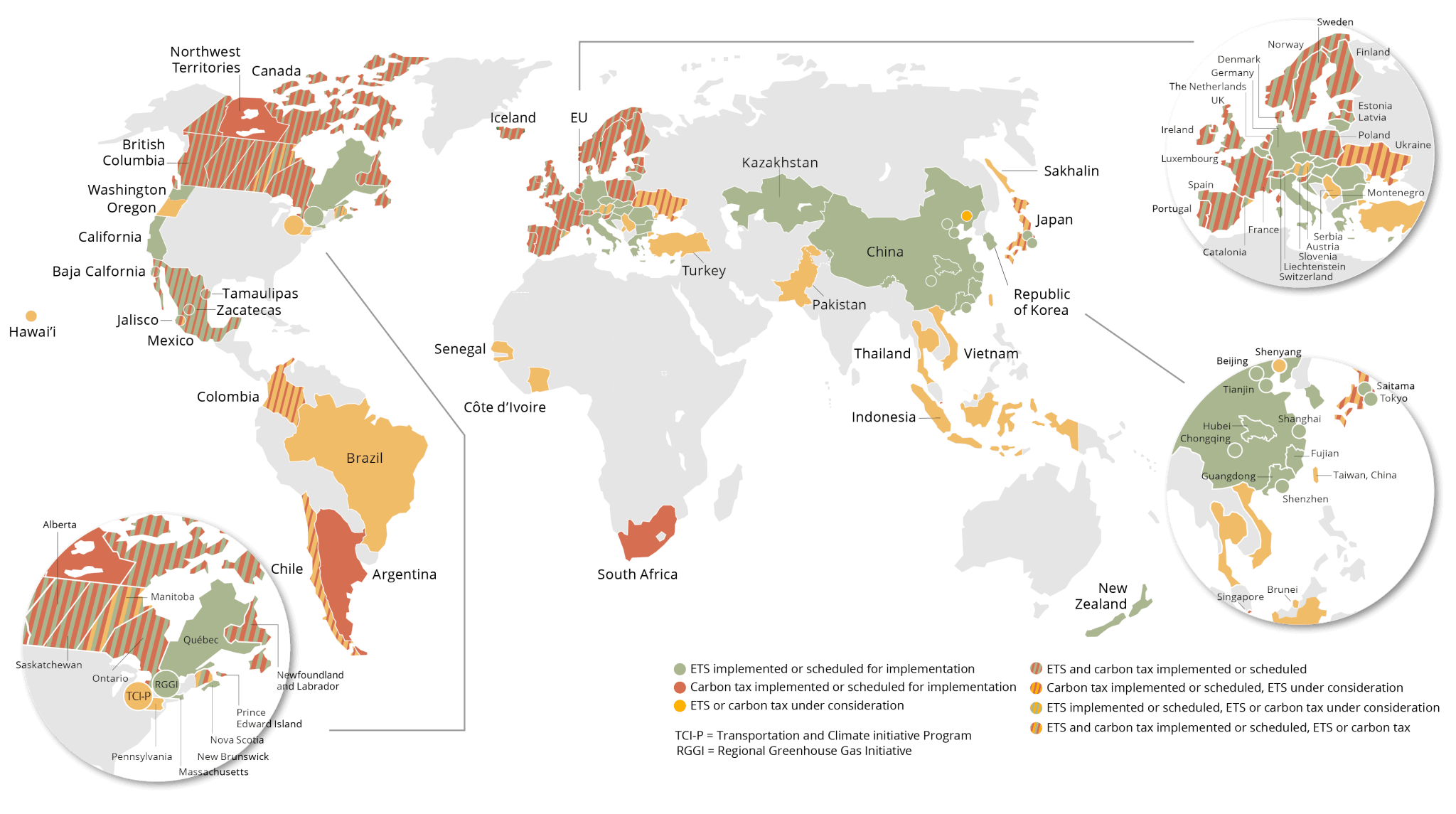

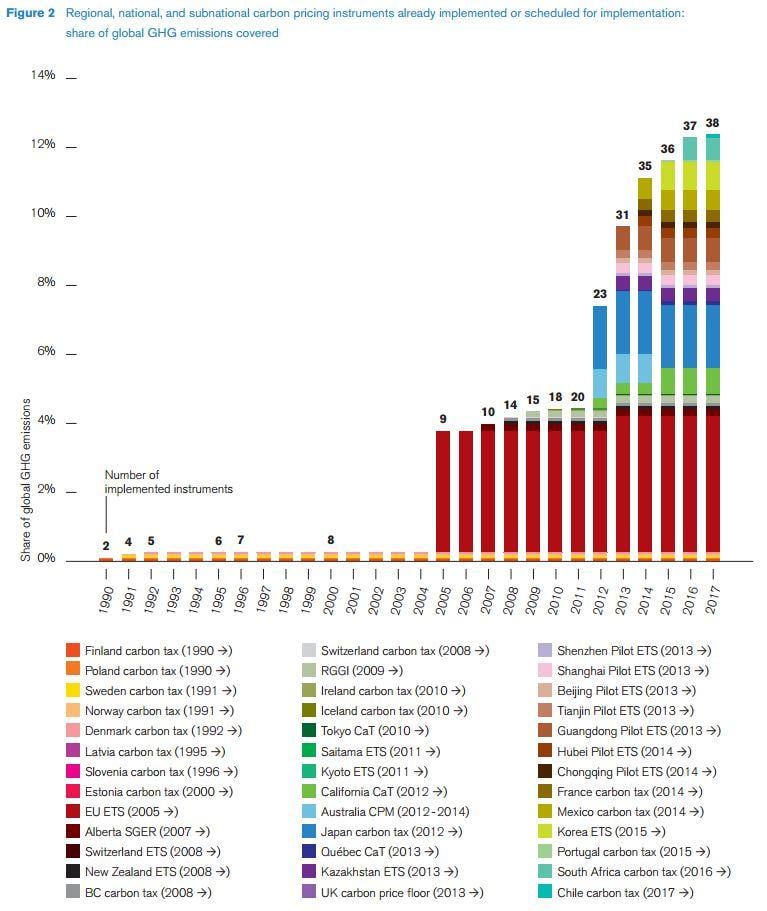

Carbon Pricing 101 Union Of Concerned Scientists

Carbon Tax Or Cap And Trade Which Is More Viable For Chinese Remanufacturing Industry Sciencedirect

Carbon Tax Vs Carbon Trade Source Taschini Luca Simon Dietz Naomi Download Scientific Diagram

What Is Carbon Pricing Canadian Canola Growers Association

Washington State Finally Passes A Cap On Carbon Emissions Grist

Pdf Economic Efficiency Of Carbon Tax Versus Carbon Cap And Trade Semantic Scholar